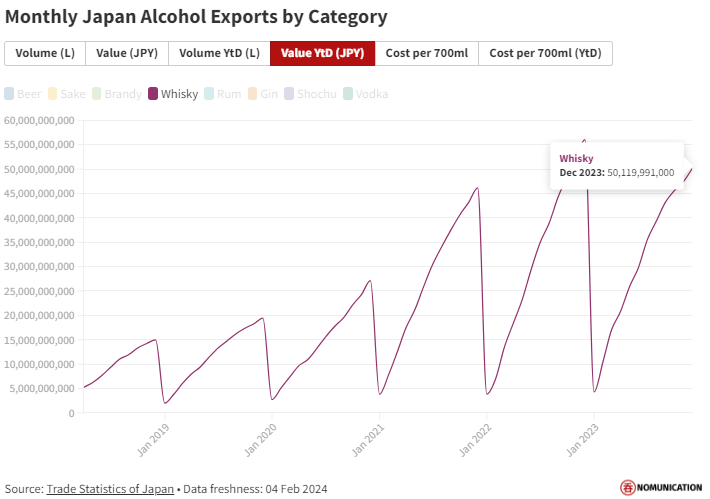

It’s official: yearly Japanese whisky exports have declined, ending a 15-year growth streak.

New figures released this past week from Japan Customs shows the total volume of whisky exported from Japan in 2023 was 12.9 million liters, and the total value was just over 50 billion yen. That’s compared to 14.2 million liters at 56 billion yen in 2022. This works out to a decline of 9% in volume and 10.7% in value.

Moreover, looking at the monthly data, November 2023 was the lowest month for volume and value since May 2020.

What happened?

For starters, it looks like people across the world were simply drinking less whisk(e)y in 2023.

Scotch exports: volume down by 20% in the first half of the year. Irish exports: value down by 14% for the year. Then there’s the US, where off-trade spirits sales dropped by 4.7% for the year until November (and the holiday season apparently didn’t go well). Men’s Journal says the market for collectibles, including whisky, is “cratering.” Japanese whisky simply had a bad year in international markets, like every other whisk(e)y on the planet. Case closed?

Let’s drill down. Here’s a breakdown of the changes we saw between 2022 and 2023 for Japan’s top 10 export markets (by value in 2022).

| Country | 2022 Volume (L) | 2022 Value (JPY) | 2023 Volume (L) | 2023 Value (JPY) | % Change Volume | % Change Value |

|---|---|---|---|---|---|---|

| All Countries | 14,250,323 | 56,051,574,000 | 12,927,023 | 50,119,991,000 | -9% | -11% |

| China | 2,160,436 | 19,616,597,000 | 1,554,977 | 13,213,810,000 | -28% | -33% |

| USA | 3,225,978 | 10,989,248,000 | 2,836,201 | 10,554,058,000 | -12% | -4% |

| France | 2,846,889 | 5,044,109,000 | 2,417,891 | 3,994,288,000 | -15% | -21% |

| Singapore | 744,923 | 3,709,215,000 | 597,835 | 4,099,706,000 | -20% | 11% |

| The Netherlands | 900,516 | 3,109,041,000 | 862,191 | 5,892,768,000 | -4% | 90% |

| Taiwan | 941,044 | 2,359,058,000 | 1,008,958 | 2,425,269,000 | 7% | 3% |

| Hong Kong | 194,251 | 1,734,845,000 | 105,781 | 774,563,000 | -46% | -55% |

| Australia | 486,387 | 1,488,856,000 | 571,231 | 1,978,020,000 | 17% | 33% |

| United Kingdom | 184,352 | 1,451,785,000 | 174,646 | 1,067,148,000 | -5% | -26% |

| Macau | 65,425 | 1,195,785,000 | 23,037 | 153,679,000 | -65% | -87% |

China, China, China. A 33% decrease in imported value. There’s our answer, or at least 6.4 billion yen of it. It’s no secret that China banned imports of seafood from Japan due to the Fukushima water discharge. Whisky isn’t seafood—while some bottles of Talisker may qualify—but lots of different exports from Japan to China were down for the year.

Weakened by a real estate slump and unemployment, it’s easy to blame the Chinese economy for Japanese whisky’s slight decline. CNN recently called 2023 “one of the country’s worst economic performances in over three decades.” Maybe it’s not the best environment to be buying luxury goods like Japanese whisky. In fact, exports to Hong Kong and Macau–two locations often used by wealthy Chinese to offshore assets from the Mainland government–were down by a staggering 55% and 67% in JPY terms.

Outside of the hard data, I’ve also heard from a few people that the secondary market for Japanese whisky in China took a nosedive in 2023. This would, in theory, put downward pressure on the primary market as well.

There are some interesting numbers outside of China money. The USA saw a 12% decrease in volume but 4% decrease in value, indicating people are buying one bottle of nice stuff rather than two bottles of regular stuff. The same thing happened in Singapore, with a 20% drop in volume but an 11% gain in value. I’ll also have whatever the Dutch are smoking, because they have all turned into connoisseurs overnight. They showed a slight decrease in volume but spent nearly twice as much to get it.

My take

Despite this latest data, I think anyone would agree the growth of the category has been astronomical. Back in 2013 there was 2.7 million liters of whisky exported from Japan at around JPY 4 billion yen. Here we are just a decade later and those numbers are now 12.9 million liters at JPY 50.1 billion yen. It doesn’t matter if you’re usually trading hog futures, dogecoin, or Pokemon cards. Japanese whisky is a unicorn.

My take: Japanese whisky will continue to grow so long as the premiumisation of the global spirits market continues. People are buying bottles of Hibiki and waiting to crack them open for special occasions. I view this as a lull.

If super-premium Japanese whisky is what people want, they’ll be able to explore over 100 distilleries within the next few years. Competition to obtain bottles will continue to be fierce, but there will be more opportunities for people willing to venture beyond the standard Suntory and Nikka releases. Importantly, some of the first wave of post-Chichibu distilleries will be hitting the 10-year mark as soon as 2026.

And yes, “super-premium Japanese whisky” is what people want. Japan Customs shows us that Japan imported whisky from the UK for around 1285 yen per liter in November 2023. From the USA, that number drops to 802 yen. And how much did the exported Japanese whisky go for? 3886 yen, or three times the cost of Scotch and five times the cost of Bourbon.

There’s also plenty of room for more growth. 3.2 million liters of Japanese whisky was exported to the US in 2022. But that’s only a tiny portion of the 702 million liters sold in the US in the same year. Japanese whisky doesn’t even claim half of a percentage point of the US market.

While the export numbers all point towards premiumisation, I personally think markets outside Japan could also use some more affordable daily-drinker Japanese whisky. Suntory and Nikka appear not interested, instead pushing bottles like Nikka Session and Suntory Ao towards global markets. Who will step up to create the Johnnie Walker, Jameson, or Jack Daniels of Japanese whisky?

Hi there! I created and run nomunication.jp. I’ve lived in Tokyo since 2008, and I am a certified Shochu Kikisake-shi/Shochu Sommelier (焼酎唎酒師), Cocktail Professor (カクテル検定1級), and I hold Whisky Kentei Levels 3 and JW (ウイスキー検定3級・JW級). I also sit on the Executive Committees for the Tokyo Whisky & Spirits Competition and Japanese Whisky Day. Click here for more details about me and this site. Kampai!

Interesting read regarding Japanese whisky export. With the establishment of new whisky distilleries, I wonder how it will all pan out. Looking forward to the 2024 numbers.